illinois employer payroll tax calculator

Illinois State Disbursement Unit PO. FedState Employment Taxes Program FSET - a program for employers and payroll companies to electronically file and pay both their Federal and Illinois employment taxes.

Paycheck Calculator Take Home Pay Calculator

Just enter your employees pay.

. Just enter in the required info below such as wage. Yet the new employer only has in order to pay with a flat. Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. Our paycheck calculator for employers makes the payroll process a breeze. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

All you have to do is enter wage and W-4. Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above can help you with steps three and four but its also a good idea to either. The Unemployment Insurance Act was recently amended to provide for the personal liability of any officer or employee of an employer who has control supervision or responsibility for the.

Last calendar year employees contributed Medicare taxes at a rate of 145 on all wages and the employer matched that amount. This procedure only applies to nonresident alien employees who. Discover ADP For Payroll Benefits Time Talent HR More.

The Employee Database tracks salary information on state employees from the current year as well as previous years. 925 upon a wage foundation of 12960. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

The standard FUTA tax rate is 6 so your max. Paid by employer ranges from 0. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

Box 5400 Carol Stream IL 60197-5400. Illinois State Payroll Taxes What are my state payroll tax obligations. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. State Unemployment Insurance coverage Tax. Get Started With ADP.

Ad Process Payroll Faster Easier With ADP Payroll. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income.

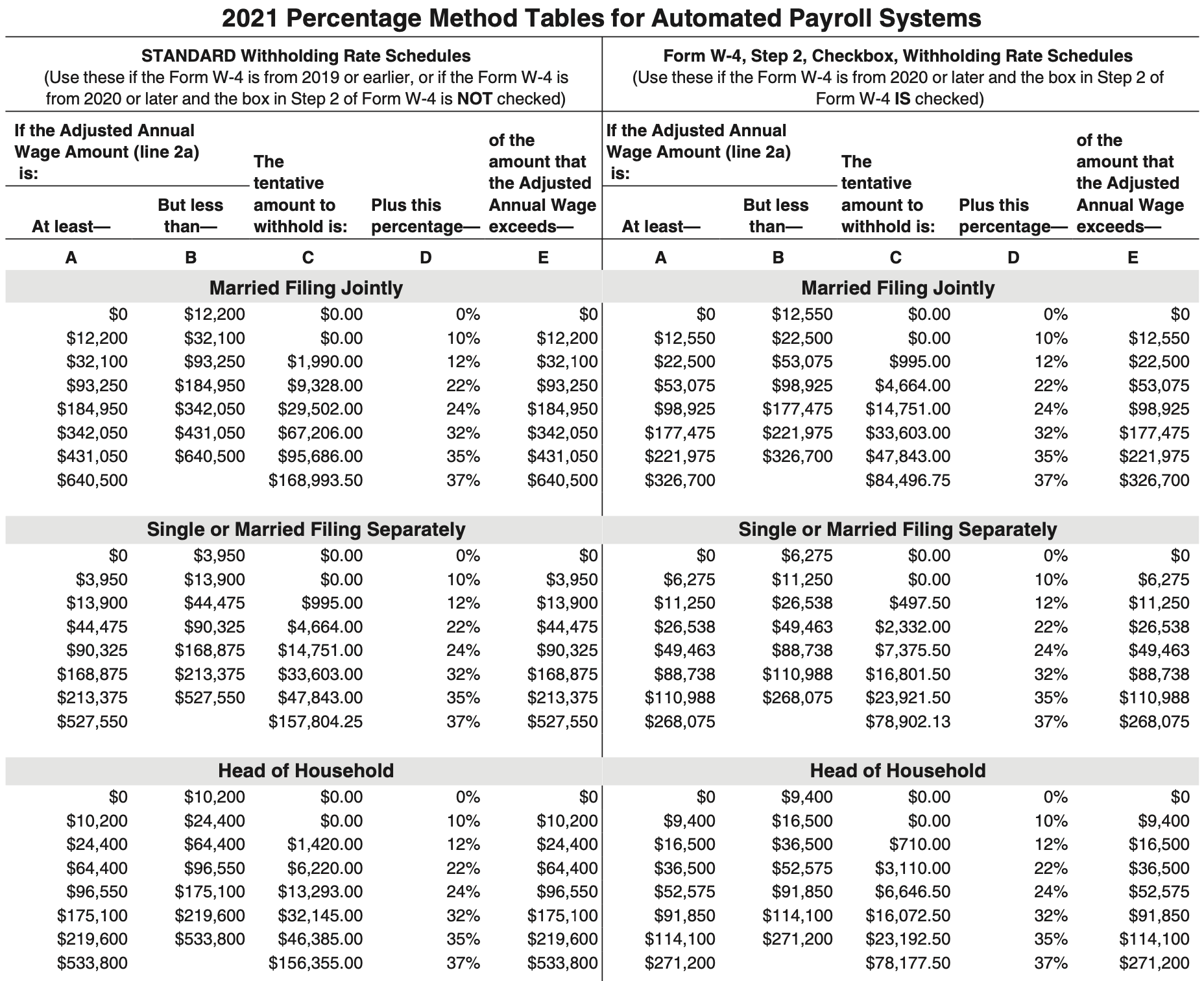

Monthly paydays are permitted for executive administrative and professional employees as well as employees on commission who are covered under the Fair Labor Standards Act. 2022 Federal Tax Withholding Calculator. This is a projection based on information you provide.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. Discover ADP For Payroll Benefits Time Talent HR More. Illinois Salary Paycheck Calculator.

The new Medicare tax rate for employees was raised to 235. Also these chart amounts do not increase the social security Medicare or FUTA tax liability of the employer or the employee. That makes it relatively easy to predict the income tax you will have to.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You can quickly calculate paychecks for both salaried and hourly employees. Illinois requires employers to withhold income taxes from employee paychecks in addition to.

It is not a substitute for the advice of. Get Started With ADP. Search by agency individual name position salary or even year of.

Ad Process Payroll Faster Easier With ADP Payroll. This calculator is a tool to estimate how much federal income tax will be withheld.

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Missouri Income Tax Rate And Brackets H R Block

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Illinois Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Step By Step Instructions Onpay

Payroll Tax What It Is How To Calculate It Bench Accounting

Employer Payroll Tax Calculator Incfile Com

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Calculator 2021 2022 Estimate Return Refund

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Payroll Taxes Methods Examples More

1 200 After Tax Us Breakdown March 2022 Incomeaftertax Com

Income Tax Calculator Estimate Your Refund In Seconds For Free

How Much Should I Set Aside For Taxes 1099

Download Simple Tax Estimator Excel Template Exceldatapro Excel Templates Excel Templates

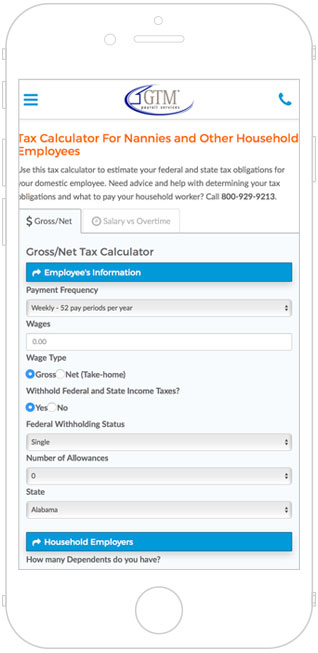

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay